When forex traders discuss market volatility, they usually focus on the London Session (where the bulk of transactions happen) or the New York Session (where U.S. economic data is released). The Asian Session (Tokyo/Sydney) is often dismissed as quiet, slow, and range-bound. However, for the astute tactical trader, this quiet period sets the stage for one of the most reliable day-trading strategies in the forex market: The Asian Range Breakout. This strategy exploits the transition from the low-volatility Asian session to the high-volatility London Open, offering clear entry and exit parameters.

[new_reg_form bgcolor=”#f43333″ text-color=”#fff” id=”regform”]Defining the Range

The strategy begins by defining the “Asian Range.” This is typically the high and low price established between 12:00 AM and 6:00 AM GMT (though times can be adjusted). During this time, the major pairs like EUR/USD or GBP/USD often consolidate in a tight box, as the European and American banks are closed. This consolidation represents a buildup of potential energy. Traders mark the high and low of this box on their charts.

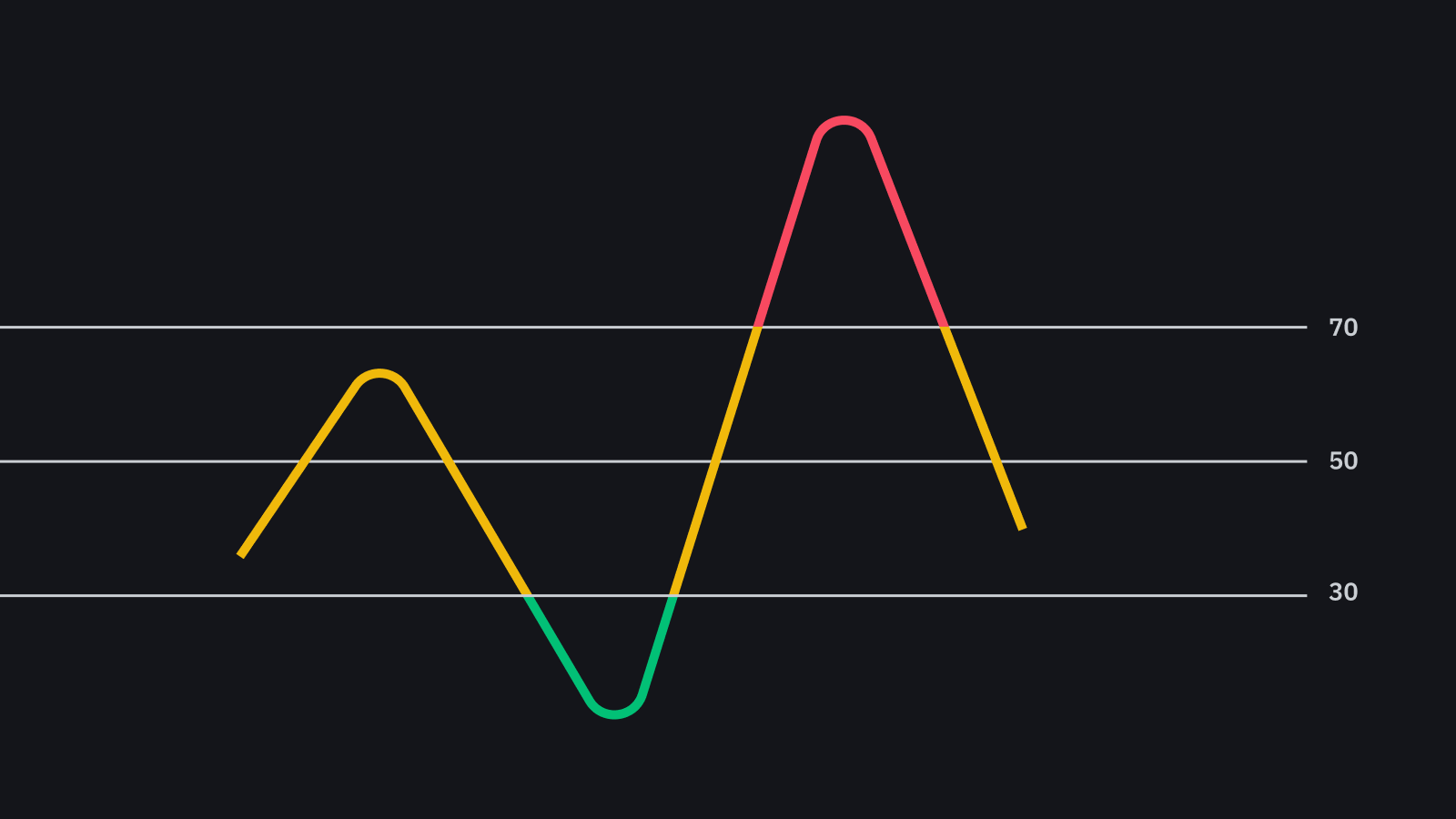

The London Open Liquidity Grab

At 7:00 AM or 8:00 AM GMT, the “London Open” occurs. The European interbank market comes online, and volume explodes. Often, the first move of the London session is a “fake-out” or a “liquidity grab.” The price might briefly spike above the Asian Range high to trigger the stop-losses of early sellers, only to reverse and crash aggressively downwards. Alternatively, it might just blast through the range in a genuine breakout.

The Breakout Strategy involves waiting for a confirmed move out of this box.

- The Aggressive Entry: Buy immediately as the price breaks the Asian High.

- The Conservative Entry: Wait for the price to break the High, then pull back to retest the High as support, and then buy.

Managing the Trade

The targets for this strategy are often based on the average daily range (ADR). If a pair typically moves 80 pips a day and has only moved 20 pips during the Asian session, there are 60 pips of potential “expansion” left for the day. Traders will often target the previous day’s high or low. This is a pure price-action strategy that relies on the recurring behavior of market participants.

Why It Works

This strategy works because of the structural nature of the forex market. The hand-off between the Asian and London sessions is a daily event that forces a shift in liquidity. It is a repeatable phenomenon. To execute this strategy effectively, a trader needs a broker with tight spreads. Since the Asian Range can be narrow, paying a high spread can eat into profits significantly.

A broker like the YWO online broker, known for its competitive pricing and fast execution, is ideal for this type of precision breakout trading. Mastering this specific setup adds a powerful weapon to a trader’s arsenal, proving that even the “quiet” times of the market can be profitable if approached with the right Technical Analysis.

Adam Fent is a forex trader who has been involved in the markets since he was a teenager. He started out by day trading penny stocks, and eventually transitioned to Forex because of its liquidity and 24-hour nature.

He has been consistently profitable for the past several years, and is always looking to improve his trading skills. When he's not trading, he enjoys spending time with his wife and two young children.