✅ Smart Automation Technology

✅ International Presence

Investing options:

4.4

Products, markets, & assets:

4.1

Deposits & withdrawals:

4.3

Fees & costs:

4.2

Platforms & usability:

4.1

Safety & reliability:

4.2

Research & analysis tools:

4.3

Education & learning resources:

4.3

| Best For | Long-term investors seeking automated portfolio management with global reach. |

|---|---|

| Key Strengths |

Smart automation technology

Robust security infrastructure

International presence

|

| Notable Weaknesses |

Vague Feature Descriptions

|

| Bottom Line | CalvenRidge Trust delivers sophisticated automation wrapped in surprisingly accessible packaging, what makes it a perfect tool for long-term investors. |

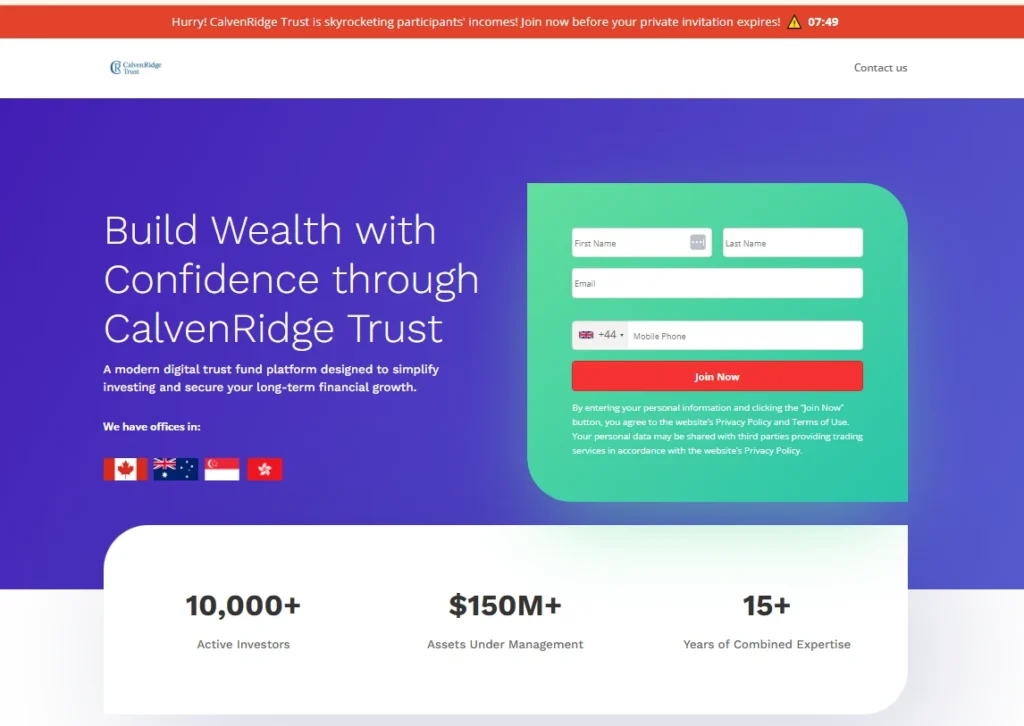

CalvenRidge Trust operates across four major financial hubs – Canada, Australia, Singapore, and Hong Kong. While they don’t explicitly state their founding year, their marketing materials claim “15+ years of combined expertise” across their team. The platform currently manages over $150M in assets for 10,000+ active investors.

Their regulatory status isn’t clearly outlined in available materials, which honestly raises some questions. Most legitimate platforms lead with their licensing credentials.

The company positions itself as bridging traditional wealth management with modern automation. They’re targeting investors who want the “set it and forget it” approach but with more sophistication than your typical robo-advisor.

Their philosophy centers on long-term wealth building through diversified portfolios and smart automation. Not groundbreaking, but solid.

1. Smart Automation Technology The 24/7 algorithmic optimization is genuinely appealing. Most investors struggle with timing and emotional decision-making – removing these factors could improve returns significantly. The real-time market analysis and automatic adjustments sound sophisticated.

2. International Presence Operating across Canada, Australia, Singapore, and Hong Kong provides geographic diversification and suggests regulatory compliance across multiple jurisdictions. This global footprint also implies access to international markets.

3. Security Focus Bank-level encryption and trusted custodian arrangements show they take asset protection seriously. In an era of frequent data breaches, this emphasis on security infrastructure is reassuring.

4. User Experience Design The platform appears genuinely designed for accessibility. Most wealth management tools are either dumbed-down robo-advisors or complex platforms requiring significant expertise. Finding the middle ground is tricky.

1. Vague Feature Descriptions Their marketing materials are heavy on buzzwords but light on specifics. “Smart automation” and “diversified portfolios” sound great, but what exactly are the algorithms doing? What asset classes? What’s the rebalancing frequency?

What we do know:

Here’s where things get murky. CalvenRidge Trust doesn’t publish a clear fee schedule in their marketing materials, which is… concerning? They mention “bank-level security” and “trusted custodians” but skip the nitty-gritty of what this actually costs.

Most legitimate platforms are upfront about:

The absence of this information makes it impossible to properly evaluate their value proposition against competitors.

CalvenRidge Trust emphasizes “diversified portfolio” access and “wide range of asset classes” but doesn’t specify exactly what’s available. The marketing copy suggests:

The platform seems to focus more on portfolio construction than individual security selection, which aligns with their trust fund positioning.

Their “Smart Automation” feature appears to be the core offering:

The automation sounds impressive.

Desktop Platform – No specific details provided about desktop capabilities. Given their emphasis on automation, the platform likely prioritizes portfolio monitoring over active trading tools.

Mobile Application – Similarly vague. They mention “seamless experience” and “intuitive platform” but provide zero specifics about mobile functionality.

Web Platform – The company emphasizes user-friendliness for beginners, suggesting a streamlined web interface. However, without hands-on testing, it’s impossible to evaluate actual usability.

CalvenRidge Trust mentions “dedicated support” and “experts” available for guidance, but doesn’t detail their research offerings. For a platform managing $150M+, this seems like a missed opportunity.

Most competitive platforms offer:

The absence of these details suggests either they’re light on research or just terrible at marketing these features.

Support Channels:

They promise “dedicated support” and “personalized assistance” but don’t specify:

The Ottawa headquarters suggests Canadian regulatory oversight, which is generally positive for investor protection.

This is actually where CalvenRidge Trust seems to shine:

However, they don’t specify:

The signup form requests basic contact information and appears straightforward. However, without details about:

It’s impossible to evaluate the actual onboarding experience.

Given the automation focus, daily interaction is probably minimal by design. This could be perfect for long-term investors or frustrating for those wanting more control.

1. Hands-Off Long-Term Investors

People who want professional-grade portfolio management without the complexity or high minimums of traditional wealth management. The automation handles rebalancing and optimization while you focus on… literally anything else.

2. International Investors

The multi-jurisdictional presence could be valuable for expatriates or those with international tax considerations. Having operations across four countries suggests they understand cross-border investing complexities.

Active traders seeking advanced tools won’t find what they need here. The platform clearly emphasizes long-term automated strategies over day-to-day trading capabilities.

Fee-sensitive investors should definitely wait for more transparency before committing funds. Without clear cost disclosure, it’s impossible to determine if CalvenRidge Trust offers competitive value.

Based on available information:

CalvenRidge Trust presents an intriguing proposition – sophisticated automation with international reach, positioned for long-term wealth building. The emphasis on security and user experience suggests they understand what matters to investors.

CalvenRidge Trust could be excellent for investors seeking automated, long-term portfolio management with international sophistication. The security focus and user experience design seem genuinely thoughtful.

All content on JD Forex Broker is carefully verified by our editorial team to meet strict accuracy and transparency standards. The information presented here is backed by the following trusted sources.

JD Forex Broker offers independent reviews and educational content only. We do not provide financial advice. Trading and investing in forex, stocks, crypto, or commodities carries risk, and you should never invest more than you can afford to lose.

Adam Fent is a forex trader who has been involved in the markets since he was a teenager. He started out by day trading penny stocks, and eventually transitioned to Forex because of its liquidity and 24-hour nature.

He has been consistently profitable for the past several years, and is always looking to improve his trading skills. When he's not trading, he enjoys spending time with his wife and two young children.