The carry trade is one of the most classic and enduring strategies in the foreign exchange market. At its core, it is a simple concept: borrow a currency with a low interest rate and use those funds to buy a currency with a high interest rate, profiting from the interest rate differential.

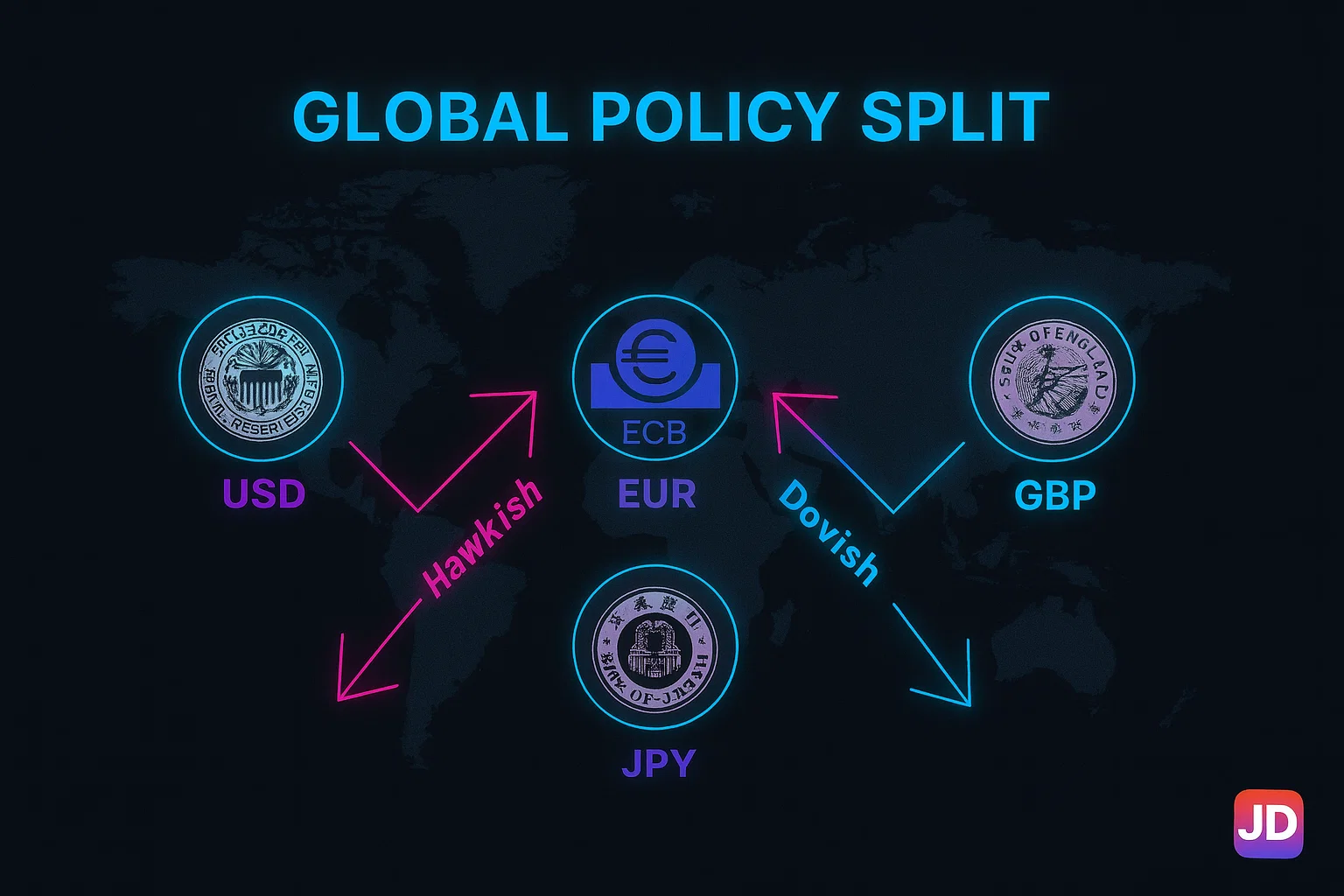

For decades, this strategy has been a favorite of hedge funds and institutional investors, and with the accessibility of modern retail trading platforms, it has become a viable, albeit complex, strategy for individual traders as well. In 2025, with global central banks on divergent monetary policy paths, the opportunities for carry trading are significant, but they are accompanied by a unique set of risks that must be carefully managed.

The mechanics of the carry trade

The engine of the carry trade is the interest rate differential between two countries. When a trader holds a forex position overnight, they are subject to a “rollover” or “swap” fee, which is an interest payment calculated based on the difference between the two currencies’ central bank rates. If a trader is “long” a high-yielding currency against a “short” low-yielding currency, they will receive a net positive interest payment each day they hold the position.

For example, if the interest rate in Australia is 4% and the rate in Japan is -0.1%, a trader who buys the AUD/JPY pair is effectively borrowing Japanese yen at a very low cost to buy Australian dollars, earning a positive carry of approximately 4.1% annually, amplified by leverage. The goal of a pure carry trade is to generate a consistent income stream from these daily interest payments.

The ideal environment and associated risks

The carry trade is most profitable in a low-volatility environment where market sentiment is generally positive or “risk-on.” In such a climate, investors are more willing to sell “funding” currencies like the Japanese yen or Swiss franc to invest in higher-yielding, growth-oriented currencies like the Australian or New Zealand dollar.

However, the primary risk of the carry trade is exchange rate volatility. A sudden, adverse move in the currency pair’s price can easily wipe out months or even years of accumulated interest payments. This is particularly dangerous during a “risk-off” event, such as a global recession or a geopolitical crisis. In these scenarios, capital rushes back into the perceived safety of the funding currencies, causing pairs like AUD/JPY to drop precipitously.

A trader who is heavily leveraged in a carry trade can face catastrophic losses. This highlights the absolute necessity of a disciplined approach to Trading Psychology and Risk Management.

Advanced carry trading strategies

Sophisticated traders rarely enter a pure carry trade based on the interest rate differential alone. They combine the carry trade with other forms of analysis to improve their odds of success.

Combining with Trend Following: A trader might only enter a carry trade if the currency pair is also in a clear, confirmed uptrend on a higher timeframe. This ensures that in addition to earning positive carry, they are also positioned to profit from capital appreciation. This requires a strong understanding of Technical Analysis to identify and validate these trends.

Portfolio Diversification: Instead of concentrating on a single carry trade pair, a trader might build a diversified portfolio of carry trades across multiple different currencies. This spreads the risk, so that a negative move in one pair might be offset by a positive move in another. Managing a diverse portfolio of this nature requires access to a wide range of markets.

Hedging with Options: An advanced trader might use options to hedge the downside risk of their carry trade. For example, they could buy a put option on the AUD/JPY pair, which would increase in value if the pair’s price falls, offsetting some of the losses from their spot position.

The role of the brokerage

The choice of brokerage is particularly important for a carry trade strategist. A trader needs a broker that offers competitive and transparent swap rates, as these are the direct source of profit for the strategy. A platform like the YWO trading platform provides detailed information on the swap rates for all its offered pairs.

Furthermore, a broker with a variety of account types might offer specific accounts designed for longer-term traders, with more favorable overnight fee structures. By providing a stable and transparent environment, the right broker can be a crucial partner in the successful execution of a carry trade strategy.

The role of geopolitics in shaping forex trends

While economic data and central bank policies are the primary drivers of currency movements, the foreign exchange market is also deeply sensitive to the shifting sands of geopolitics.

From international trade disputes and military conflicts to national elections and diplomatic breakthroughs, geopolitical events can act as powerful, often unpredictable catalysts, triggering significant volatility and reshaping long-term currency trends.

For the forex trader in 2025, maintaining a keen awareness of the global geopolitical landscape is not just a matter of general knowledge: it is a critical component of a comprehensive market analysis framework.

Adam Fent is a forex trader who has been involved in the markets since he was a teenager. He started out by day trading penny stocks, and eventually transitioned to Forex because of its liquidity and 24-hour nature.

He has been consistently profitable for the past several years, and is always looking to improve his trading skills. When he's not trading, he enjoys spending time with his wife and two young children.