If you are a seasoned forex trader, you possess a formidable skill set. You understand leverage, you live and breathe technical analysis, and you are comfortable navigating the world’s largest financial market.

As cryptocurrency matures into a recognized asset class, many forex veterans are eyeing it as the next logical frontier for diversification and opportunity. The good news is that your years of experience in the forex market give you a significant head start. This isn’t about starting from scratch. It’s about adapting your proven strategies to a new and exciting landscape.

What Stays the Same: Your Core Trading Toolkit

The transition from forex to crypto is smoother than you might think because the foundational principles are identical. Your expertise in chart analysis is directly applicable. Support and resistance, trendlines, chart patterns like head and shoulders, and candlestick analysis are universal languages of price action.

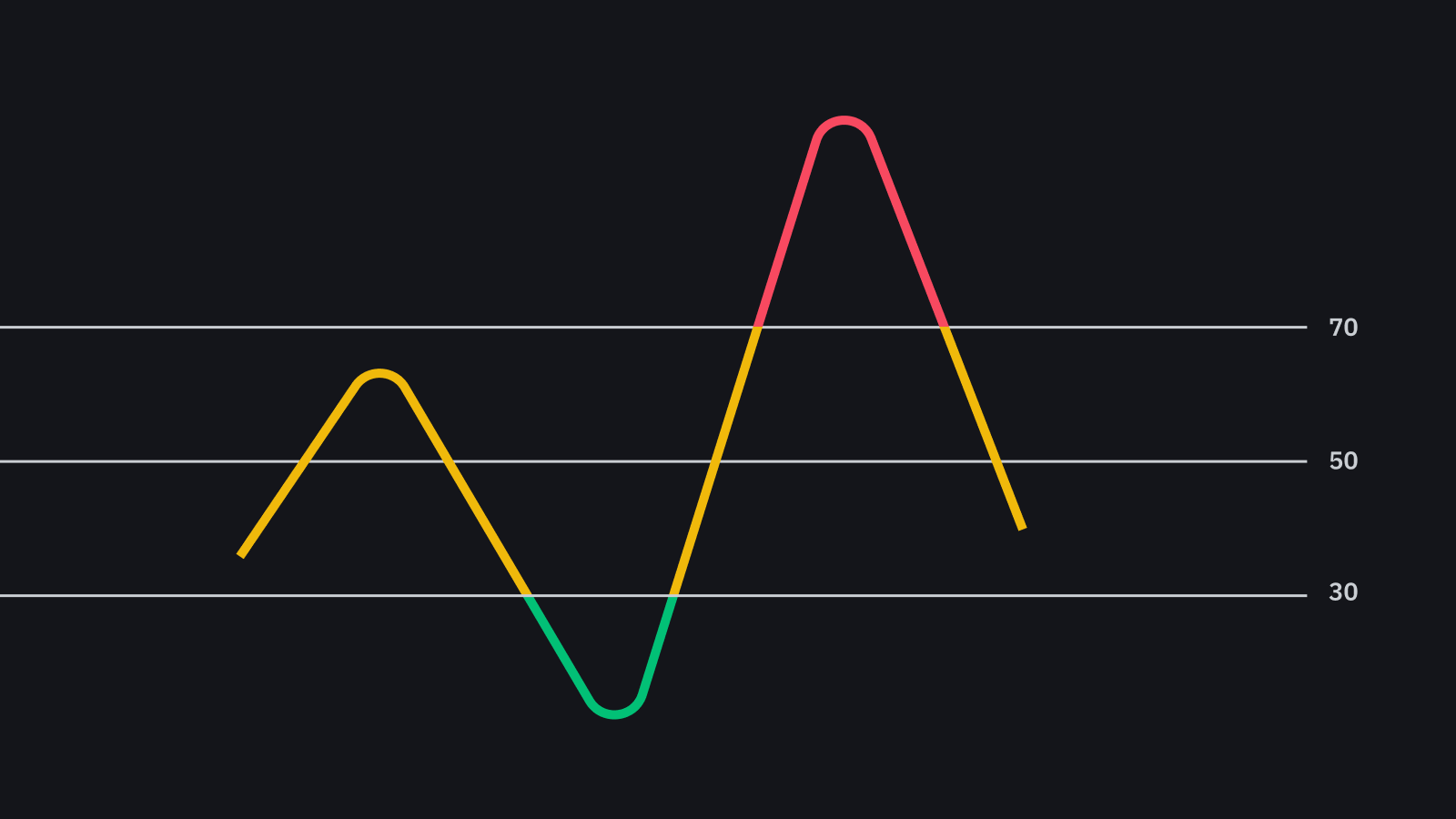

Similarly, your favorite technical indicators, whether it’s the RSI for momentum or moving averages for trend direction, work just as effectively on a BTC/USD chart as they do on EUR/USD. The 24/7 nature of the crypto market will also feel familiar to anyone accustomed to the forex market’s round-the-clock sessions.

Key Differences to Adapt To

While your technical skills are transferable, there are crucial differences to master. First, the source of volatility is different. Forex is driven by macroeconomic data, interest rate decisions, and geopolitics.

Crypto, on the other hand, is heavily influenced by technological developments (like network upgrades), adoption news, investor sentiment, and the broader narrative of decentralization. Second, the concept of “fundamentals” changes. Instead of analyzing a country’s GDP, you’ll be analyzing a project’s whitepaper, its developer community, and on-chain data.

Finally, the mechanics of asset ownership can be different, introducing concepts like self-custody and hardware wallets, which are foreign to traditional forex trading where the broker handles custody.

Choosing a Platform That Bridges Both Worlds

As a forex trader, you shouldn’t have to abandon the professional tools and secure environment you’re used to. The ideal transition involves using a platform that excels in both arenas.

Many traders who have come to rely on brokers like YWO for seamless forex trading are now seeking platforms that also offer robust tools for cryptocurrency trading. This allows you to manage your diversified portfolio from a single account, using a familiar interface and a consistent set of risk management tools.

It eliminates the friction of moving capital between separate crypto exchanges and your primary forex broker, creating a more efficient and integrated trading experience. By choosing a multi-asset broker, you can step confidently into the crypto market while standing on the firm ground of your forex expertise.

Adam Fent is a forex trader who has been involved in the markets since he was a teenager. He started out by day trading penny stocks, and eventually transitioned to Forex because of its liquidity and 24-hour nature.

He has been consistently profitable for the past several years, and is always looking to improve his trading skills. When he's not trading, he enjoys spending time with his wife and two young children.