Trade relationships are a major determinant of a country’s economic health and, by extension, its currency’s value. When a country’s exports are strong, it creates demand for its currency from foreign buyers. Geopolitical tensions that lead to trade disputes and the imposition of tariffs can disrupt these flows and have a significant impact on the forex market.

For example, the trade disputes between the United States and China have led to periods of heightened volatility for the Chinese yuan (CNH) and the currencies of other trade-dependent nations like Australia. A sudden announcement of new tariffs can trigger a “risk-off” move, sending capital flowing into safe-haven currencies like the Japanese yen and Swiss franc.

Conflict and instability: The flight to safety

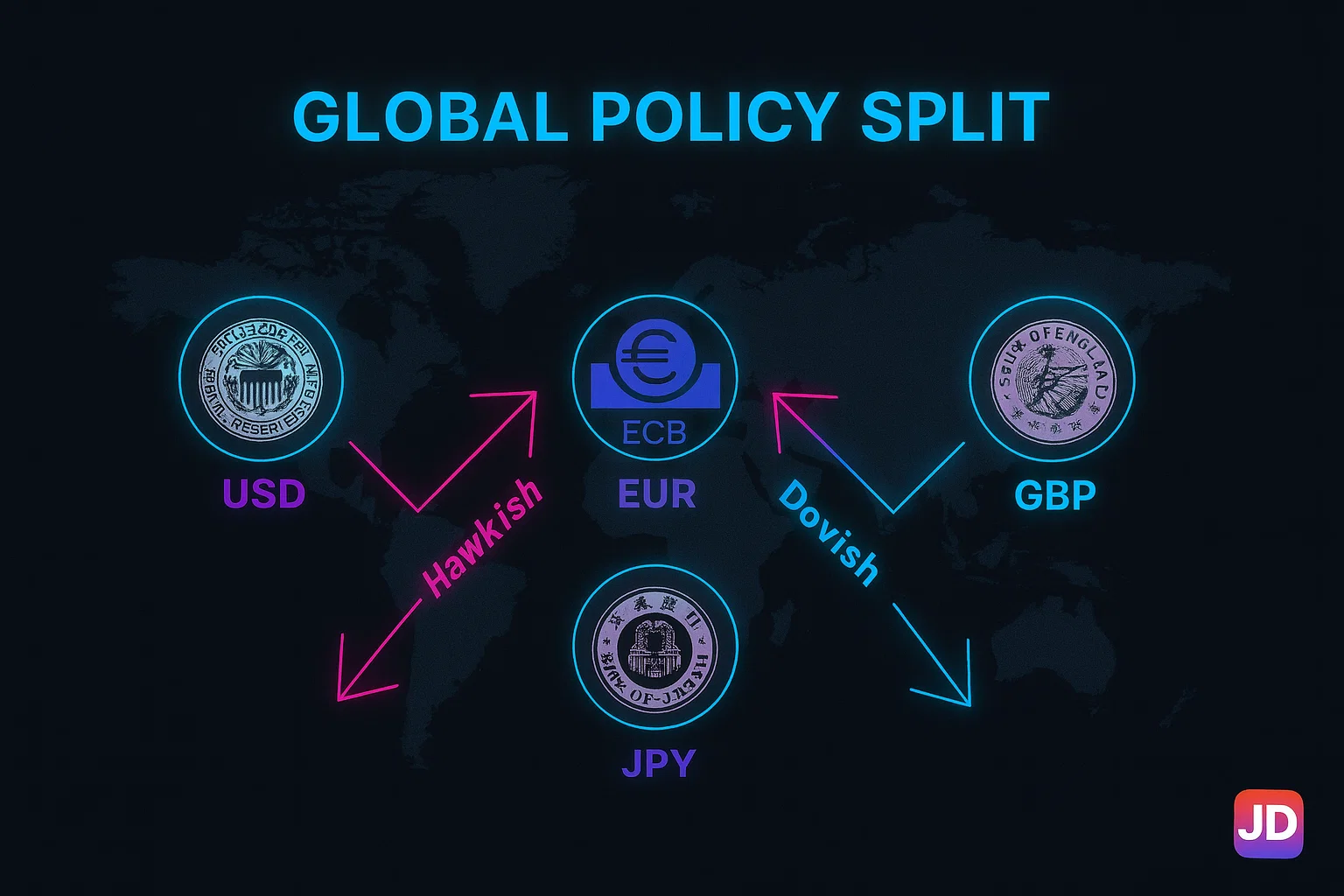

Military conflicts and periods of regional instability are among the most powerful drivers of a “flight to safety” in the financial markets. When a major conflict erupts, global investors tend to sell riskier assets and move their capital into assets that are perceived to be safe and stable. In the forex market, this typically means a surge in demand for the U.S. dollar, the Swiss franc, and the Japanese yen.

The currencies of countries that are geographically close to the conflict or economically dependent on it are likely to fall sharply. For example, the conflict in Ukraine has had a profound and lasting impact on the value of the euro. A trader who is aware of escalating geopolitical tensions can position themselves defensively or even profit from the resulting flight to quality. This requires a deep, qualitative assessment of the global political situation, a key part of any robust Fundamental Analysis framework.

Elections and political uncertainty

National elections in major economies are another key geopolitical event for forex traders to monitor. The outcome of an election can have significant implications for a country’s fiscal policy, trade policy, and overall economic direction. The period leading up to a closely contested election is often marked by increased currency volatility, as the market prices in the uncertainty. A surprise election result can trigger a massive, immediate repricing of a currency.

For example, the Brexit referendum in the United Kingdom led to a historic crash in the value of the British pound. Traders often use options to speculate on or hedge against the volatility associated with elections, buying straddles or strangles that will profit from a large price move in either direction.

Navigating a complex world

For the individual trader, keeping track of the complex and fast-moving world of geopolitics can be a daunting task. This is where the tools and resources provided by a high-quality brokerage become invaluable. A trading platform that integrates a real-time professional newsfeed is essential for staying abreast of breaking geopolitical developments.

A platform like the YWO trading platform, which provides access to a wide range of global markets, allows traders to act on these events by trading a variety of different currency pairs and safe-haven assets like gold.

Furthermore, offering different account types with varying leverage levels can allow a trader to adjust their risk exposure based on the perceived level of geopolitical uncertainty. In a world where a single headline can move markets by several percent, a geopolitical awareness is a non-negotiable part of a forex trader’s toolkit.

Adam Fent is a forex trader who has been involved in the markets since he was a teenager. He started out by day trading penny stocks, and eventually transitioned to Forex because of its liquidity and 24-hour nature.

He has been consistently profitable for the past several years, and is always looking to improve his trading skills. When he's not trading, he enjoys spending time with his wife and two young children.